Table of Contents

This guide to succeeding in a one person business model gives you an easy to use blueprint on how to start and operate your premier solopreneur venture.

I tackled my first business after seven years of corporate experience and an MBA degree. I still made plenty of mistakes.

In this post I’ll take you through the different parts of a solopreneur model so you can build a business that makes you happy and solves the right problem for your audience.

We’ll cover strategy, operations, finance, and other key topics. I’ll also share with you important lessons I learned during the fourteen-plus years of my first solopreneur journey.

For quick reference, you can check out these solopreneur FAQs and get fast answers on the one person model.

Here’s a snapshot of the steps you should take to succeed in your one person business model.

- Identify your passion and skills

- Define your niche and unique selling proposition

- Chat with a legal advisor

- Set up an efficient home office

- Leverage your work experience in a particular industry

- Understand the pros and cons of a one person business model

- Explore strategies to market, finance and operate your business

Identify Your Passion and Skills

All you need to start a great business is passion, right? Not really.

Here’s your formula for success: Passion + Expertise = Success

First, your customers expect you to provide helpful solutions and products right out of the gate. It’s essential that you have the expertise to solve their challenges. Second, passion can be fun to follow, yet there may not be a market for your passion project.

I also had several years of diverse experience in the finance industry.

When you start your business, take time to make sure you genuinely like your industry and that you have the expertise to create solutions and products people find helpful.

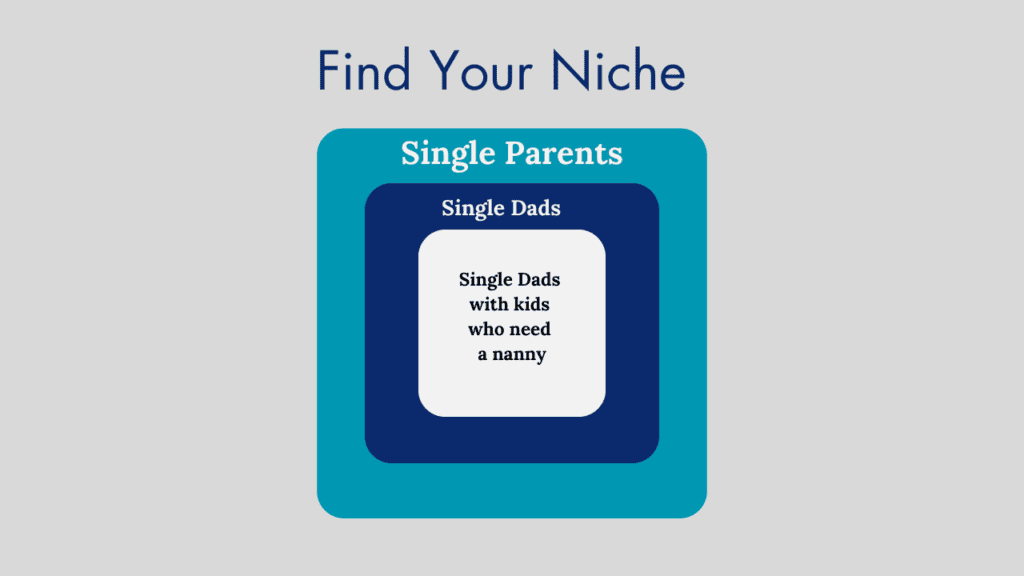

Find Your Niche

Every successful business operates within a specific niche and offers a unique selling proposition (USP).

Your niche is the specific segment, or sandbox, of the market you want to target. Your USP is the special promise you make to your audience that solves their problem.

You stand a greater chance of attracting customers who want your products if you identify a smaller niche where you can gain a competitive advantage.

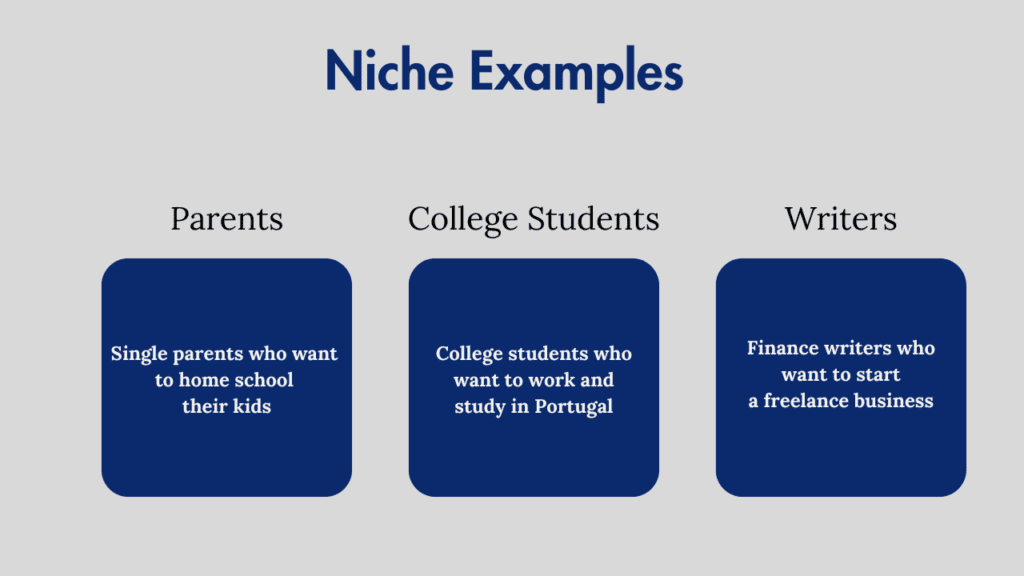

Examples of a smarter niche might include:

- Single parents who want to home school their children

- College graduates who want to travel and work abroad in Europe

- Finance writers who want to start a freelance business (check out this site with Lauren Ward who excels in the freelance writing arena.)

When you create your simple business plan, take time to explore and discover the appropriate niche, or sandbox, where you can win.

If you pick a sandbox that’s too broad, it’ll be tough to dial in your marketing message and create specific products to solve a specific client problem. You’re likely to compete with too many other business models.

If your niche is too small, you may not have enough customers (ex., serving decaf coffee to all coffee lovers in a town of 50 people). It may take time to discover your ideal niche, and I encourage you to start with a smaller sandbox than one that is too broad.

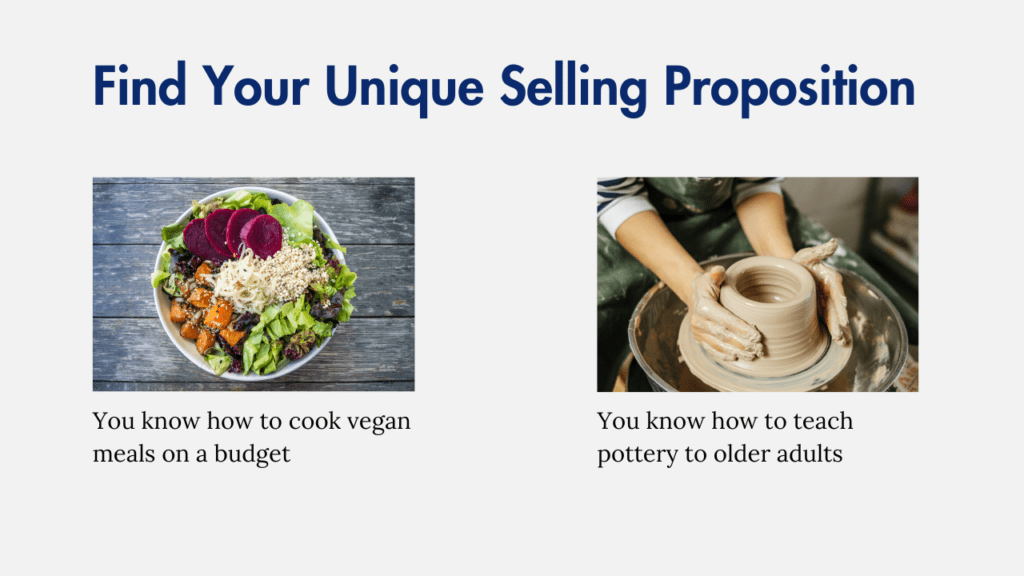

Your USP (unique selling proposition) is your edge or expertise that sets you apart from your competition.

When I started my financial services practice, I made the common mistake of wanting to help everyone.

When I made time to analyze different customer markets and then target prospects who occupied a unique sandbox, my sales grew. Yes, it took time to find this niche, and it was worth every effort. If you try to help everyone, you end up helping no one.

Customers seek differences when they choose a solution, and it’s essential that your unique selling proposition helps you stand out in a competitive space.

Your goal in converting your skills into solutions people buy is to present a transition that solves a problem. Introduce a special process to create this customer objective, and you’ll have an advantage.

Once you have your niche and your USP it’s smart to talk with a legal advisor.

Chat with a Legal Advisor

When you start a business it’s key to get great advice from a legal advisor who knows the rules and regulations.

The legal issues of starting a business can be complex, and you can make big mistakes. Connect with a legal advisor in your area as you write your strategy statement and business plan.

Any fees you might pay an advisor will be less than fees you might have to pay if you fail to follow the local, national, or international rules once you start operations.

Explore these topics with your legal advisor:

Make a quick check list with these questions, too.

- Do you need to create a special business entity?

- Do you need to obtain certain licenses?

- Do you need to consider special trademarks?

- Do you need to register your business in your local area or state?

A smart advisor will help you navigate the business regulation landscape for your particular region and industry.

They will give you recommendations on how to proceed and guidelines to follow. It’s also smart to check in with your landlord if you rent your living space.

Most solopreneur business models are digital, yet if you’re going to keep inventory for sale, it’s prudent to see if your lease has any restrictions on business activities within your space.

You can explore more ideas on how to run your business from home. I share many of them in this blog post about running a home business.

Set Up Your Workspace

One of the biggest perks of working on your own is the freedom to set up your workspace.

No more waiting in line for the printer or having to get company approval to update your operating system, PC, laptop, and network.

The downside, however, is that you pay for the equipment and tackle the IT challenges.

Picking and creating your workspace is key as helps you stay productive.

Choose a space that has few distractions. You want the option to close a door, if possible, and block out the noises or distractions.

Establishing your home office in an independent room gives you the solitude you’ll need to focus and lets you close the door at the end of the day so you can leave work and enjoy your personal living space.

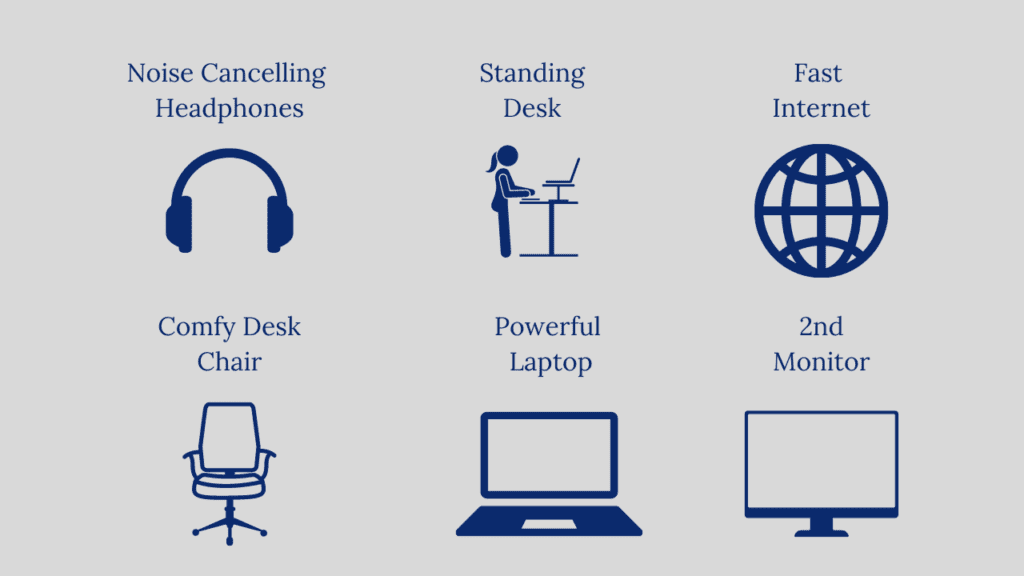

Here are the items I suggest you use in your home office:

Take the time to find and coordinate your ideal workspace, and then get the best equipment you can afford.

I promise your productivity will soar, and you’ll enjoy working from home.

Leverage Your Work Experience

Imposter Syndrome

Do you wonder if you have imposter syndrome?

This arises when a solopreneur realizes they might be out of their league once they start to create solutions and interact with customers to solve difficult problems.

Is imposter syndrome real? Sure.

Will you encounter it as you start your one-person business? Perhaps.

If you have at least three years of experience in your industry, you should be in great shape; yet, if you’ve been a chef in an Italian restaurant and you now want to start a new business in auto body repair, you may have to spend time in an auto garage before you launch your business.

The key to moving past imposter syndrome is to know your material and take steps to increase your knowledge. It take time and experience to gain comfort with a particular topic.

Here’s what I suggest to tackle imposter syndrome:

- Ask friends and colleagues to tell you the three problems they often ask you to solve

- Apply these problem-solving skills to an industry where you have experience (ideally more than 3 years)

- Identify a BIG customer problem in your industry that you feel comfortable tackling

- Create a process or product that fixes this customer problem and test it in the marketplace

Keep Learning to Boost Your Self-Development

Business success depends not only on what you already know but also on your desire to learn.

Continually improve your skills, adapt to market changes, and stay up-to-date with industry trends.

One of the ways in which I stay up-to-date on specific industry trends and customer preferences is through newsletters. I suggest you pick 2 or 3 in your industry and 2 in a related industry. Give yourself a few issues to see if the author(s) hit home on the key topics and write in a style that appeals to you.

Here’s a complete guide to solopreneur newsletters.

If you enjoy learning about the ins and outs of converting your skills into solutions people buy, you can check out the Solopreneur Doorway newsletter.

The right newsletter combination will give you weekly or biweekly solutions to common business challenges and remind you of key themes to address within finance, marketing, and operations.

Plus, you’ll gain insight into your competition, which may compel you to make smart changes to your business model.

Build Your Personal Brand

Creating your personal brand is a long-term process, yet it will help you day after day.

When you first begin your business start here:

- What is a personal brand?

- How do you create your personal brand?

What is a personal brand?

Simply stated, your personal brand is the ‘feeling’ customers get when they interact with you, your solutions, and your products.

It’s the collection of emotions that customers experience when they read your newsletter, visit your site, or purchase your solutions.

When you think about Apple’s products, you get an instant sensation of what those products can do and how they make you feel when you use them. This occurs because Apple has spent billions of dollars crafting an image and a reputation.

You don’t need to spend billions to build your brand, yet I encourage you to write down a few words that you want people to use when they think of your products.

Your personal brand conveys your passion to solve these problems, and it builds a strong bond between you and your customers.

How do you create your personal brand?

You need three components.

- Time

- Consistency

- Message

Time

It can take years to fully develop your personal brand. Yes, I know this is a long time; yet, consider how long the top brands took to build their brands.

Customers don’t know you yet, and they encounter thousands of data points each week. If you post on social media for a year, you might develop a reasonable number of followers (via LinkedIn, YouTube, Instagram, and TikTok), yet only a handful will pay close attention to your message.

Lauren Ward discusses her insight on how to grow your Linkedin audience in this blog post.

While you might develop a large follower base, statistics show It takes a long time to foster a community of customers who consistently follow your content and who trust your insight.

Consistency

Consistency is the key to building a brand on social media.

Develop a posting schedule that fits your schedule and learn all the best practices for the platform you choose.

Learn the ins and outs of this platform and refine your message. Once your brand starts to grow and you gain followers who look forward to your content, you can then expand to another social media space.

Dedicate at least one year to one platform before you move on to a second.

While some social media platforms require a more frequent posting schedule, your job is to pick a platform and schedule you can maintain. As you look at your day-to-day tasks for operating your business, be honest about the time you can commit to posting on social media.

It’s better to start slowly and increase your frequency than to commit to a frequency you can’t maintain.

Message

Your message to your audience has to reflect your mission and vision.

As your posting experience grows, you’ll find that your messages adopt a certain tone. It’s okay to mix up your tone from time to time, but don’t fall victim to a shotgun approach.

Once you find which tone and posts resonate with your audience, stick to them. Your audience will identify with you more often and develop a stronger connection with your business if you maintain a consistent attitude and personality within your content.

The Pros of One Person Business Model

Independence and Control

One of the nicest parts of the one-person business model is the independence and control.

You make the decisions, set the direction, and be the boss. This freedom can be empowering and tough to manage. There are multiple tasks and responsibilities within the one person business model.

First, you may have to work harder to operate your own business than you did as an employee.

Second, you’re responsible for your own schedule.

In the first few weeks, you’ll likely feel there are too many tasks to tackle. This feeling will ease once you start to operate. Use a calendar and organization system that suits you, and be diligent about sticking only to the tasks that drive revenue and secure new business.

As your revenue increases, you might consider seeking help with a virtual assistant. The right VA can handle a boatload of tasks and free you up to focus on strategy, new business, and sales.

I wrote about how to collaborate with a virtual assistant and included an interview with a dynamic business owner who specializes in that area.

Flexibility

Whether you’re a night owl or an early riser, building your own business allows you to create a schedule that suits you.

Take time in the first several months to track the days and times when you are most productive.

You might find that you can best manage your business and personal schedule when you set up specific times to work and play. Experiment with different options, and I assure you, you’ll find the ideal approach.

Direct Connection with Customers

In a solo business, you have a direct connection with your customers. You can provide personalized service, respond to feedback quickly, and build genuine relationships.

As your business grows, you’ll want to seek additional support. You can collaborate with a virtual assistant or hire a part-time (or full-time) employee.

If you opt to hire employees, I encourage you to chat with your business attorney.

Employees bring tremendous leverage to your business and a few additional responsibilities. You’ll be happier if you structure any employment agreements with insight and advice from your legal aides.

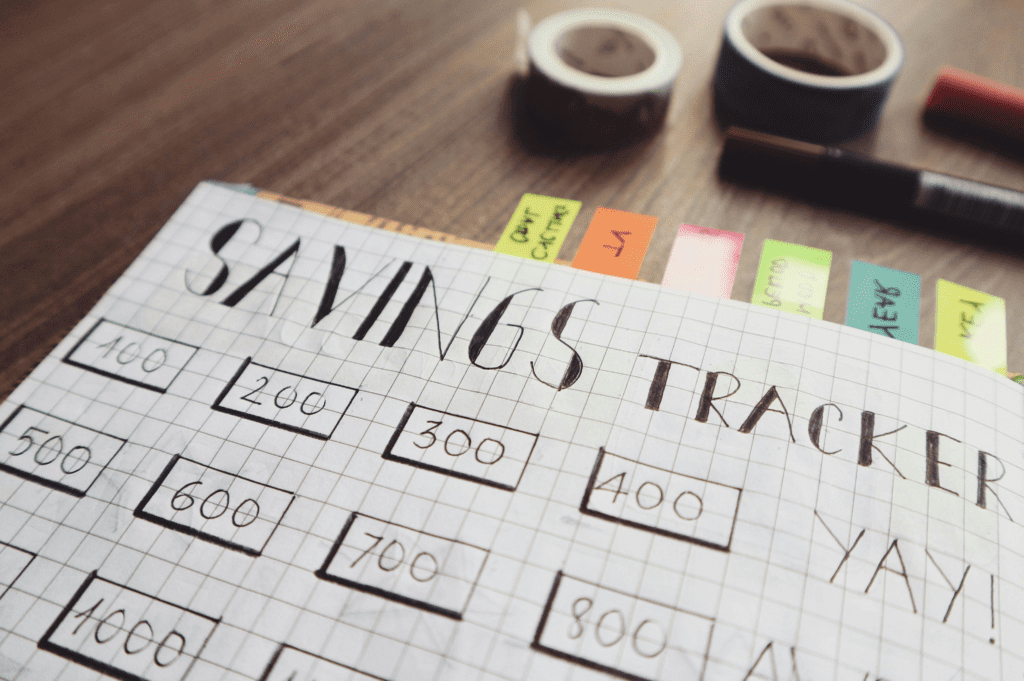

Low Overhead and Expenses

The financial burden of running a business by yourself is often lower than that of larger enterprises. There are no huge employee salaries or large office rentals, which can lead to higher profit margins.

The biggest financial issue I see with new solopreneurs is cash management. When you move from a steady employee paycheck to an up-and-down money cycle in the solopreneur world, you need to carefully watch your cash flow.

Buying equipment, paying for monthly technology subscriptions, and then waiting for customers to pay you (or buy your solutions) can cause financial stress.

As you write your business plan, you might want to chat with your financial advisor and accountant to gain important insight on key financial topics. Build a forecast of your expenses and your sales so you can feel comfortable waiting for your business to generate cash flow.

In addition, remember that it’s not always easy or fun to track your expenses, coordinate your bank statements, and prepare monthly financial reviews. If you have a financial background, you might feel comfortable tackling those duties.

If not, you might explore collaborating with a bookkeeper.

A professional bookkeeper can help you organize your finances and interact with your accountant when it’s tax time.

The Cons

Isolation and Loneliness

Running a solopreneur business can be isolating, and you might miss the connection with other employees.

There are a few helpful ways to combat this isolation so you can maintain energy, momentum, and confidence.

- Join a Facebook group that focuses on your industry and exchange ideas with other solopreneurs. (I belong to two different groups on blogging: each helps me advance my writing and business model.)

- Coordinate a weekly online meetup with two or three other folks who operate a one person business model (they don’t need to work in your industry).

- Set up a weekly or bi-monthly meeting to have coffee or lunch with other solopreneurs; set an agenda for each meeting; and and take turns educating one another on insight and tips to advance your business.

When I launched my newsletter, Solopreneur Doorway, I met weekly with two other incredible solopreneurs who were in the early phases of starting their newsletter. The meetings helped us exchange ideas and support one another in a new endeavor.

Work-Life Balance Challenges

Balancing work and your personal life can be challenging when you’re solely responsible for your business. It’s crucial to establish clear boundaries and allocate time for relaxation and self-care. Simple steps, including a walk, a workout, and even a few minutes of stretching in your home, can give you energy. I work for 30-minute stretches and then get up from my desk to clear my head.

Set your agenda and remember to keep your brain and body active as you work. Refresh and rejuvenate to keep your day productive.

Limited Resources and Expertise

In a solopreneur business, you may face resource limitations. You might need to wear multiple hats and learn new skills. However, these challenges can be overcome with dedication and a growth mindset.

It’s fun to learn new skills and develop further layers of expertise. In the early days, you’ll likely have to solve tech, operations, financial, and customer challenges.

Once you gain momentum, I encourage you to focus on one or two key responsibilities. Dedicate all other tasks to automation (technology or websites that assist you) or start to collaborate with a virtual assistant.

Risk and Uncertainty

Every business venture carries risks, and one-person business models are no exception.

Economic downturns or shifts in your industry can impact your earnings. Building an emergency fund and staying adaptable are key strategies to mitigate risks.

It’s essential that you keep track of your business finance accounts and make smart decisions to manage cash flow.

The one person business model can bring outstanding financial rewards. It won’t happen right away. Plan accordingly, and be honest about the amount of money you need to operate and expand your business.

It’s always smart to chat with your accountant and financial advisor.

Market Your Business

Personal Branding

A strong business brand, along with a well-crafted personal brand, can set you apart in a crowded market. Consistency in messaging and visual identity is key.

I believe most solopreneurs start with their personal brand and then introduce components of their business. These days, consumers want to buy from individuals they trust and who can help them solve a key challenge. If you can dedicate time to a specific social media channel (or write a weekly newsletter), you’ll have the opportunity to build both brands. Remember, this takes time.

If you’re curious how a newsletter can advance your business, I share details of my newsletter experiences in this Solopreneur Doorway issue.

Leveraging Testimonials and Reviews

Gaining traction in your solo venture can be daunting in the first few months. When you interact with a customer who has had a positive experience, ask them to share a testimonial.

Positive reviews enhance your credibility and encourage potential customers to trust your products or services. Encourage satisfied customers to leave reviews and then post them to your website and social media profiles. There are many online tools you can use to simplify the testimonial experience.

You might check out Senja. I use them and have found their interface easy to implement when I collect testimonials.

Finance Your Business

Self-Funding

Many one-person businesses start with minimal investment, relying on personal savings or income generated from the business itself.

If you choose to use money from your personal savings or checking account, I encourage you to build a budget and chat with your financial advisor.

It’s always helpful to fully understand what financial implications your one person business model might bring to your personal finances. In the long run, your finances may benefit from the one-person business model, yet it can be a roller coaster in the early months and years.

It’s helpful to fully understand how much money you’ll need to keep your lifestyle on track as you adjust to operating your business.

Small Business Loans

If your business requires significant capital, you can consider exploring small business loans or grants tailored for entrepreneurs. In this category, I suggest chatting with a local bank to explore your options.

While larger banks may or may not suit your risk profile, you might find that local banks can help you understand the pros and cons of securing a loan. Chat with your financial advisor and accountant to ensure you understand and adjust to any financial commitments you might make with a lender.

Saving and Budgeting

Sound financial management is essential.

Create a detailed budget, save for future expenses, and monitor your finances closely to ensure sustainability. Whether you use your own spreadsheets or collaborate with a bookkeeper, it’s vital that you stay on track with your financial responsibilities.

Your accountant can make recommendations on the types of business banking accounts you might consider and how to use those accounts to stay in compliance.

Operate Your Business

Time Management and Productivity Tools

Efficiency is paramount for one-person business models. Utilize time management and productivity tools, like calendars and task management apps, to stay organized and focused.

Every solopreneur finds different tools to help maximize productivity and keep a healthy balance between work hours and personal time.

Financial Management

Maintaining accurate financial records is crucial. Financial management software can simplify invoicing, expense tracking, and tax preparation. I encourage you to reach out to your financial advisor and accountant when you are planning your new venture.

Each of those professionals will ask you questions and provide insight you may have never considered. In addition, you’ll likely gain more free time to pursue new business if you collaborate with a bookkeeper to maintain accurate books and records.

Max Your Earnings

Diversify Your Income Streams

It’s popular to tell solopreneurs that they have to generate income from multiple sources in order to have a viable business.

While this makes sense on paper, the reality is different. Don’t spread your business across too many channels when you start. Instead, take the time to develop your solopreneur strategy so you can test, improve, and launch one successful product or service.

You may want to follow the social media superstars who have six or seven ‘passive’ income streams. I empathize. It’s an attractive option to collect income from multiple channels.

In the first several months, stay true to your initial product or service and make it viable before you expand into other revenue channels.

Once you gain traction with an audience and you build your ‘brand’, you’ll have options to diversify and bring on other revenue sources.

Pricing Strategies

Establishing competitive and profitable pricing strategies is essential. Research your market and competitors to set your prices effectively. It can be difficult to settle on the right pricing strategy for your specific business.

The common pricing strategies include bundling, low-priced options, and high-priced options. Each carries pros and cons. I suggest you closely research your industry and your competition to see which options make sense for your niche.

You can explore pricing strategies in this issue of Solopreneur Doorway.

Scaling and Growth

While a one-person business may start small, don’t overlook the potential for growth. Identify opportunities as you proceed that can unlock a new customer base and expand your personal brand.

When I launched my solopreneur finance practice, it took me at least a year to properly identify my niche and implement a strategy that worked well with my customer demographics. Solopreneurs often make the mistake of investing too much too soon in tools, courses, and products that don’t add immediate value. Explore your industry.

Growing your one person business model comes from expanding your market (within the right niche) and positive customer testimonials.

Focus on solving one BIG customer challenge and then over deliver on your top solutions. A positive customer journey from ‘ouch’ to ‘oh, yes!’ generates tremendous momentum. Happy customers will help you scale faster than most products.

Conclusion

The one person business model is more popular today than ever.

If you have the energy, expertise, the right risk profile, and a solid strategy, I am confident you can create a sensational business. Remember these key points, and you’ll have a tremendous advantage.

- Identify your passion and skills

- Define your niche and unique selling proposition

- Consult with your business attorney

- Set up your home office

- Leverage your work experience in a particular industry

- Understand the pros and cons of a one person business model

- Explore strategies to market, finance and operate your business

FAQs

What is the best business type for one person?

The best business type for one person is one that combines your skill with your ability to solve a big problem for your audience. A few of the common businesses for one person include copywriter, coach, consultant and SEO specialist.

These days, you can start a business from your home and specialize in many different areas.

The key is to understand solopreneur strategy vs planning and take time to develop a smart business plan.

What is a one-person business?

A one-person business is called a solopreneur business.

You can organize the business in different ways, and it’s important to talk with a business attorney before you start.

You can explore the differences between one-person businesses and entrepreneurs in this article.

Helpful Resources

Solopreneur Doorway is the solopreneur newsletter that converts your challenges into more clients and higher sales. It’s fun, helpful and free.

Every Wednesday, you get growth ideas in less than 3 minutes to make sure you run a profitable solopreneur business.

When you’re ready, you can explore a custom, 90-minute strategy session to make sure you convert your idea and skills into a solution people will buy.

I wish you tremendous success in your venture.

Recent Posts

Choose Your Category

About Erik

Erik Duncan has over 17 years of business and finance experience including investment banking, investment management and starting a successful finance company. He received his MBA in Finance from The Wharton School of Business and his MHA from The University of Iowa.

Your Store Causing You Stress?

A free chat with Erik clears your mind and gives you immediate ideas.

"*" indicates required fields